by Jason Woldt and Michael Godfrey

This week the State of Wisconsin entered the eighth week of the Safer at Home Order [i] in an effort to mitigate the spread of COVID-19. As the number of newly reported cases begins to stabilize in most areas of the state, many Wisconsin manufacturers continue to face difficult operating conditions. To understand the impact of COVID-19 on the business climate, the Wisconsin Economic Development Corporation (WEDC) distributed two surveys [ii] in April and May to Wisconsin businesses during the COVID-19 pandemic. In this article, we provide an update to the analysis [iii] from Survey 1. Since Survey 1 in April (2020), the Safer at Home Order in the state of Wisconsin was extended through May 26th, 2020, and then overturned by the state supreme court [iv]. In addition, the federal government responded by passing the largest economic relief package in history with a component of that package offering small businesses (fewer than 500 employees) liquidity through the Paycheck Protection Program (PPP) [v]. In this article, we compare the responses of both surveys and provide commentary on the Survey 2 data showing an improvement in manufacturing viability. We offer insight showing that long-term viability is coming at the expense of cuts to employment. Finally, we analyzed the words in the written responses of both surveys using a text analysis tool, which showed no change in the sentiment of the survey respondents from April to May.

The Good – Business Viability

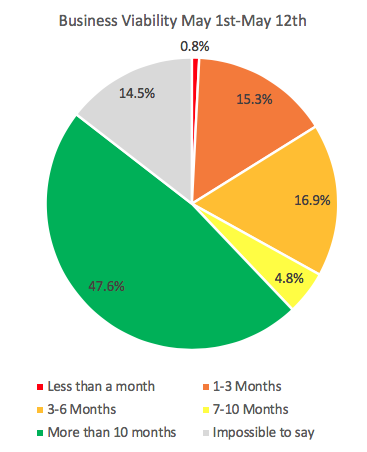

In both surveys, firms were asked to estimate their business viability under the current circumstances. From the April survey to the May survey, there is a clear improvement in the estimated viability across all categories as shown in the charts below. Most notably, the percentage of firms estimating to be a viable business for more than 10 months more than doubled from 22.7 percent in April to 47.6 percent in May.

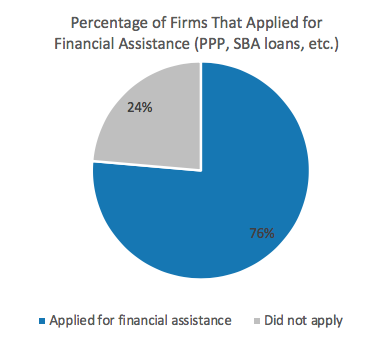

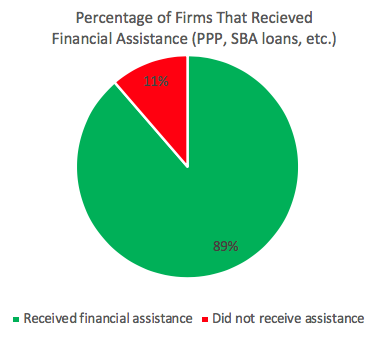

The survey data suggest that the improvement in business viability could be attributed to a mix of both government policy and strategic decision making. In terms of government policy, the survey results displayed in the two charts below show that 76 percent of manufacturing firms applied for financial assistance and 89 percent of those firms that applied received assistance under the Paycheck Protection Program.

The Bad – The Cost of Business Viability

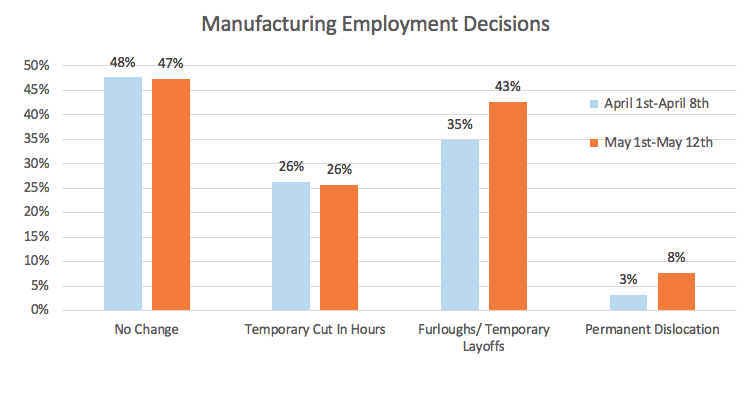

It is clear from the survey data that business viability comes at a cost. While long-term business viability has improved, manufacturing firms have been taking strategic measures to preserve liquidity, e.g., using employment cuts. Despite the design of the Paycheck Protection Program to maintain current levels of employment, the graph below [vi] shows that a larger percentage of manufacturing firms have been making cuts in employment. Most concerning is that the number of firms that executed permanent layoffs has increased from 3 percent of the firms to 8 percent of the firms. As a result, for many manufacturing firms in Wisconsin, the Paycheck Protection Program financial assistance will be considered a low interest loan rather than a grant.

Furthermore, in comparison to the first survey from April, manufacturing firms are buying fewer goods and supplies. This managerial strategy to right size expenditures to match the current level of business will preserve much needed liquidity. In addition, the percentage of firms behind on payments is approximately the same.

The Cautiously Optimistic – Wisconsin Manufacturing Sentiment

The last question on each survey asked respondents to “Please add anything else that you feel is essential regarding the impacts of COVID–19.” A total of 72 of 126 survey respondents provided written responses in the April survey while a total of 55 of 129 survey respondents provided written responses in the May survey. We analyzed the sentiment of written responses using the R statistical software and the SentimentR [vii] text analysis package. The SentimentR package enabled us to analyze the sentiment of words and phrases as more positive or negative. After we imported the text into the SentimentR package, this package assigned a sentiment score to the collection of words [viii]. The mean sentiment scores for both months were mildly positive. The results do not show a significant change in sentiment from April (mean=.035) to May (mean=.048) [ix]. The follow-up survey in June should be interesting concerning sentiment, given that the Safer at Home Order was struck down by the Wisconsin Supreme Court on May 13, 2020 [x].

[i] Evers, Tony, (2020). Safer at Home FAQs. Accessed May 11, 2020: https://evers.wi.gov/Documents/COVID19/English_SaferatHomeFAQ.pdf

[ii] Survey 1 (n=126) April 1st – April 8th; Survey 2 (n=129) May 1st – May 12th

[iii] Woldt, Jason. (2020) Manufacturing in Wisconsin Through the Coronavirus, The Good, The Bad, and The Ugly.

[iv] Wisconsin Legislature, Petitioner, v. Secretary-Designee Andrea Palm, Julie Willems Van Dijk and Lisa Olson, In Their Official Capacities As Executives of Wisconsin Department of Health Services, Respondents, 2020AP765-OA (Supreme Court of Wisconsin 2020): https://wicourts.gov/sc/opinion/DisplayDocument.pdf?content=pdf&seqNo=260868

[v] US Small Business Administration, (2020). Paycheck Protection Program. Accessed May 11, 2020: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program

[vi] The percentages sum to over 100 percent because some firms implemented more than one change.

[vii] Rinker, T. W. (2019). sentimentr: Calculate Text Polarity Sentiment version 2.7.1. http://github.com/trinker/sentimentr

[viii] The sentiment scale is (-2 to +1) Naldi, M. (2019). A review of sentiment computation methods with R packages. arXiv preprint arXiv:1901.08319.

[ix] We performed a two-sample assuming equal variances t-test in Excel comparing the sentiment scores for the responses of both surveys. The p-value was .749 indicating no statistical significant difference between the two samples. As follow up, we isolated those responses from companies that answer this question on both surveys (n=18). We performed a paired two sample for means t-test in Excel. The p-value was .558 indicating no statistical significant difference between the two samples.

[x] Wisconsin Legislature, Petitioner, v. Secretary-Designee Andrea Palm, Julie Willems Van Dijk and Lisa Olson, In Their Official Capacities As Executives of Wisconsin Department of Health Services, Respondents, 2020AP765-OA (Supreme Court of Wisconsin 2020): https://wicourts.gov/sc/opinion/DisplayDocument.pdf?content=pdf&seqNo=260868