FAFSA

Federal School Code

#003920

Private Loans

Students and parents are strongly encouraged to explore all sources of financial aid funding — federal and state aid programs, university and private scholarship programs — prior to considering private (alternative) student loans. Please contact the Financial Aid Office to review your options prior to applying.

Private student loans are designed to help students and their parents bridge the gap between the cost of education and the total amount of financial aid they have been awarded (e.g. scholarships, grants and federal loans).

Private (alternative) loans are different from the federal loans in a number of ways:

- Private loans are offered directly by banks and lending institutions, as opposed to the federal government. The conditions and terms of these loans often differ from one lender to another.

- Private loans are not listed on the financial aid award that students receive from UW Oshkosh. The awards listed in a student’s TitanWeb account only include federal and state aid that students are eligible for.

- Unlike federal loans, private loans are not need-based; hence, they require a credit check and/or co-signer for students under 18 or for applicants with little or no credit history.

- For all private loans, interest begins to accrue at the time of disbursement.

When looking for private loans, it is important to consider factors such as interest rates, loan origination fees, repayment terms and options, and who will be the borrower (student or parent/guardian).

Private Lender Options

The Financial Aid Office keeps a list of lenders generally used by UW Oshkosh students use on FASTChoice, an online comparison tool.

FASTChoice gives students the opportunity to learn about private (alternative) loans through the Borrowing Essentials tutorial and also with a side-by-side comparison of select lenders. These lenders comprise 95% of the private loans UW Oshkosh students take. Students are not limited to using the lenders listed on FASTChoice, though it is a helpful tool to compare interest rates, fees and benefits to identify the best option(s) for your financial needs.

Self Certification

If you apply for a private loan, you must complete a Master Promissory Note (MPN) and a self-certification form through your private lender.

The self certification form asks for the cost of attendance, estimated financial assistance and the loan period. Follow instructions listed below to access this information.

Guide to completing Loan Self Certification

Step 1: Log in to your Titan Web account.

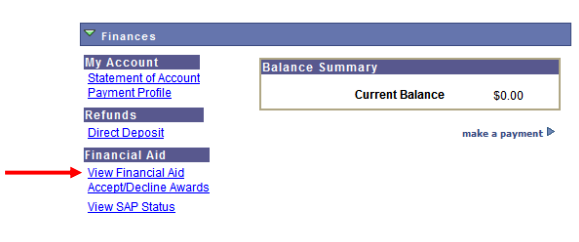

Step 2: Under “Finances,” click “View Financial Aid”

Step 3: Select the correct aid year. Keep in mind that summer sessions are included in the upcoming aid year. (Summer Fall Spring)

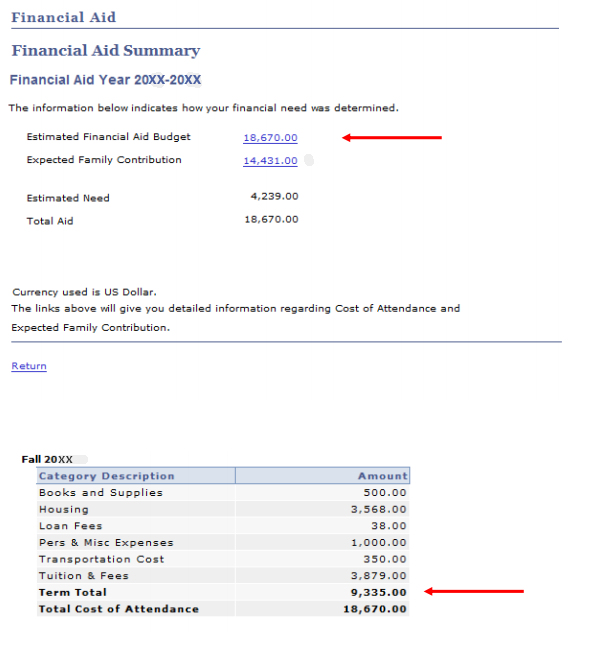

Step 4: Click on “Financial Aid Summary”

Step 5: Click on “Estimated Financial Aid Budget” to see cost of attendance information. Be aware of what term you are applying for.

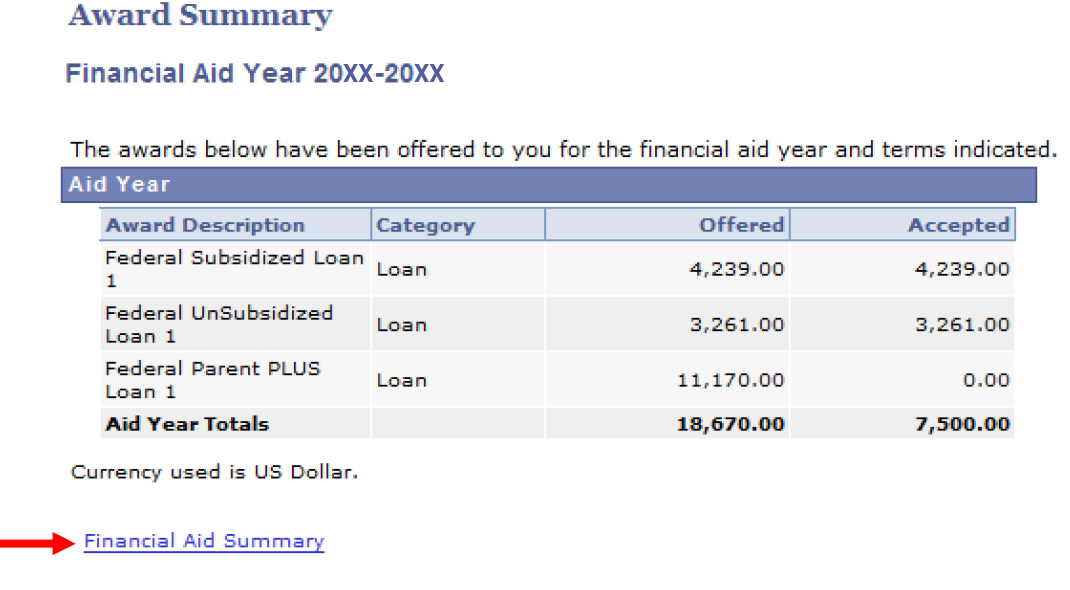

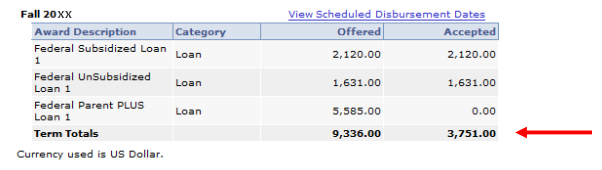

Step 6: Click on the return links until you are back to your award summary. Here you can find your estimated financial assistance. Again make sure that you are looking at the term for which the loan is intended. Only include the aid that you intending on using.

Hours and Location

Dempsey Hall, Room 104

Walk-In Hours:

Mondays and Fridays

8:00 a.m.–4:00 p.m.

Tuesday, Wednesday, Thursday

10:00 a.m. - 3:00 p.m.

Schedule an appointment with your fiancial aid Counselor

Office Hours: 8 a.m.–4:30 p.m.

Mailing Address

Financial Aid Office

UW Oshkosh

800 Algoma Blvd.

Oshkosh, WI 54901